Table of Content

I truly urge you not to be fooled by their seemingly high-end website offering, this company is far from it. They are operating their business based on keeping property owners happy forgetting about customers. I wasn't even given a chance to react to the surprising first email alerting me of damages I had apparently caused, but the company had already told me the owners shopping list requests. We are very sorry to have had to cancel your stay, however these circumstances are beyond our control and cancelling any guest’s stay is always our very last resort. There are internal structural changes that need to be made and we have tried to give as much notice as possible to ensure that an alternative arrangement can be made.

We needed North Cornwall and found Sphir. It was all last minute and Simone and team were incredibly helpful and within 12 hours we stepped into an unmitigated paradise. The views over Mawgan Porth beach and the headland could not have been bettered. The house is really well kitted out and has a very comforting family feel. The owners have obviously put a lot of love into this place.

Absolutely perfect property

However, despite this we would always try to come to an agreement with the owner to see if there is anything we can do or if it is possible to move dates and welcome you another time. Unfortunately on this occasion the owner of the property was not able to offer this. We are looking at booking an unforgettable honeymoon and were recommended this company by a friend. Although we are still deciding on which one of the AMAZING properties to go for, the customer service of the company has been second to none. Looking forward to booking our trip in the very near future.

They are a very professional company and respond quickly to every inquiry. Thank you for taking the time to leave this review and share your thoughts with us. Great property for a family stay - the experience exceeded high expectations and was exactly as described.

Unique Home Stays Benefits

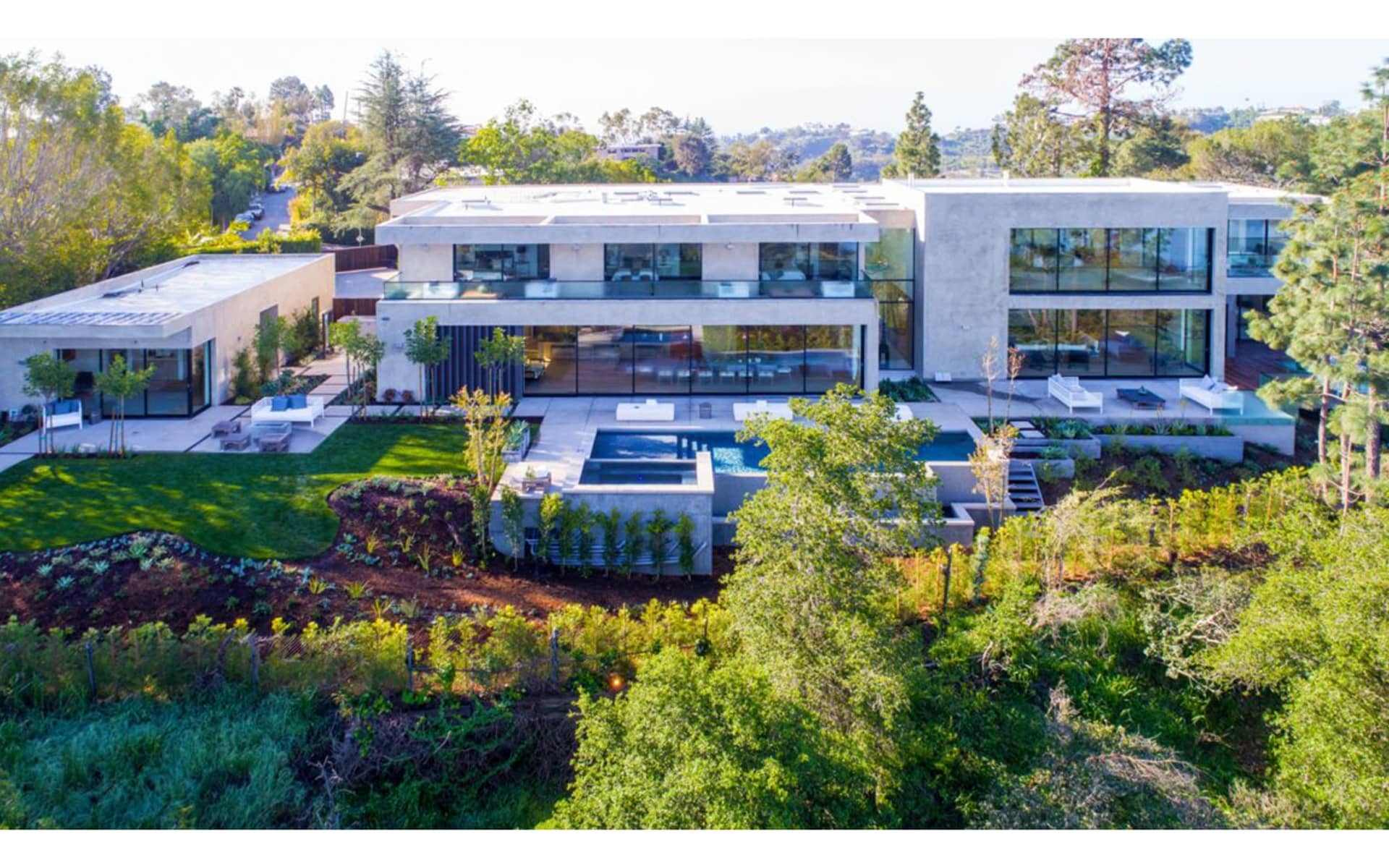

The Houdini Estate is one of the most unique Airbnbs in the US for plenty of reasons. For starters, the home is teeming with hidden passageways, caves, and even a deep-water tank where Houdini practiced his escapes. The pool was also a main practice area until just before the magician’s untimely death..

Family homestay with terrace Show all photos. Located right in the middle of Kuala Selangor, this homestay is perfectly suitable for a comfortable stay for a group of friends or family. The holiday home is 2.1 km (1.3 miles) from Kuala Selangor National Park and 10 km from the Kampung Kuantan Park. Stay in a unique, clifftop fortress on the Port Quin headland and live like king or queen of the castle. With sea views all around, this sheltered inlet is the perfect spot for rock pooling, kayaking or fishing. Inside, you'll find classic quirks from the past including arched gothic windows and a cosy open fire.

FabHotel Unique Home Stays Reviews

Please be really careful with this company. I do not recommend them at all, go with AirBnB or one of the big guys. It’s not often a place is a perfect as the brochure photo. Well this little perfectly placed property called Breakers is as the photos & better.

In terms of the house book, we requested that all owners went ‘paperless’ in 2014. Rather than a hard copy in the house, instead they are now digital documents accessed online, meaning that all information and instructions can be updated at the touch of a button. The digital house book was emailed to you on three separate occasions prior to your stay and as such it was not hidden by any means.

Best-in-class safety measures for your safe stay

The Unique Home Stays website is easy to navigate and held all the information we required regarding the property. Tangle Belle was a true delight, our first stay with Unique Home Stays, and we look forward to booking again with you very soon. There were so many little touches with excellent attention to detail - freshly baked cakes and scones, local produce, wine in the fridge. Each room had fresh flowers and the bedrooms were furnished to an extremely high standard. I booked Scarlet Hall for my daughter's 40th birthday. We chose 'Little Dolphins', phoned UHS and spoke with Luke who couldn't have been professional, friendly and helpful.

Thank you for your kind review following your stay at Zephyros. We're pleased you had such a wonderful stay and it's fantastic to hear you find the service personal and effective. We stayed for a week in Atticus House over Easter and from the moment we stepped through the front door, it felt like our second home. Beautifully decorated, and filled with home from home touches it was so easy to put our bags down and feel as though we were 'home'. Everything you could wish for, and the fact that it was dog friendly too made it even more perfect. Thank you for your review following your experience and stay at Little Inka; it sounds as if you had an extraordinary time.

Just a pebble’s throw from the sea, Country Living takes a closer look at Alba Beach House, a former fisherman´s cottage filled with vintage treasures. Alba Beach House features in C&TH’s best places to stay in the Cornish seaside town of St Ives. Pearl Lowe sits down with Interior Designer magazine to discuss her stylish poolside pad by the sea. Woman & Home explores Under the Rose; a quintessential Cornish cottage in the seaside village of Crantock. Unique Homestays contributes to The Times´ report on the climate of 2023 staycations.

Daydreamer is breathtaking, we had the most incredible 7-night stay, my husband said it was the best break he had ever had and I have to agree with him! Thank you so much, we will be coming back to you for our next break in the very near future. We’ve used Unique for a few years now and have never been disappointed with any property we’ve booked. The staff are helpful and knowledgeable and always willing to help. As a customer-focussed business, we would like to reassure you that we are sympathetic and understanding of your situation.

The quality of the finish and standard of the furnishings, kitchen equipment, bathrooms and general attention to detail was superb. Foodwise we were spoilt for choice in the local area. Gear Farm pasties are a must, bigger than your head and very tasty! Also some beautiful vegetables and meat available too.